Wine Investment

Richard Kihl Ltd has a track record of over fifty years in sourcing the finest wines for investment, for our customers. Our long-standing relationships with many of the world's most sought-after domaines are one of our greatest strengths, along with the high level of personal service we offer to our clients.

Fine wine, along with fine art, is one of the more pleasurable investment categories. You do not need to be an expert and we are always happy to give advice. As wine merchants, our focus is on wines and vintages; their potential quality and market conditions. We are not registered with the FCA and so are not qualified to give investment advice, however, we are happy to try and answer any questions, so please get in touch.

Simple supply and demand is a compelling argument for investing in fine wine. The classic appellations are strictly delimited and vineyard prices have risen rapidly in recent years. Burgundy is a case in point, where the average price per hectare of grand cru vineyard doubled from around seven million euros in 2008 to 14 million euros in 2017 (current prices are closer to 20 million euros). Added to this, the trend is for producers to reduce yields each year as they strive for ever-higher quality.

Meanwhile, demand globally is rising as new markets emerge and fine wine is added to the portfolio of luxury products desired by a growing population of millionaires. Furthermore, each time they open a bottle, supply of older vintages is lowered still further and upward pressure on prices increases.

In 2021, fine wine and collectible watches were the most successful alternative investments, both showing growth of 16%*.

The diversity of investment wines is increasing, year by year. In 2010, Bordeaux First Growths accounted for 61.9% of secondary market trade by value. By 2020, this had fallen to 32.6%. However, the number of wines that we would class as 'investment grade' is still relatively limited, with costs usually starting at £750-£1000 per case.

As with all investments, it is wise to spread funds across a portfolio of wines. A meaningful initial investment might be from £5000. We can also accept monthly direct debits from £250, making buying recommendations as and when funds have been accrued.

Importantly, wine has traditionally been regarded as a 'wasting asset' by HMRC. Wines not expected to last more than 50 years may not attract Capital Gains Tax (particularly relevant when buying older and historic vintages which already have significant bottle age). For current legislation and further details of any tax implications please speak to your financial adviser.

When the time comes to sell your fine wine, we can provide a valuation for outright purchase, or offer the wines for sale on broking terms (at our standard commission of 10%). Annual storage charges also apply. If you already have a fine wine investment portfolio, we can arrange for this to be transferred to and managed by us.

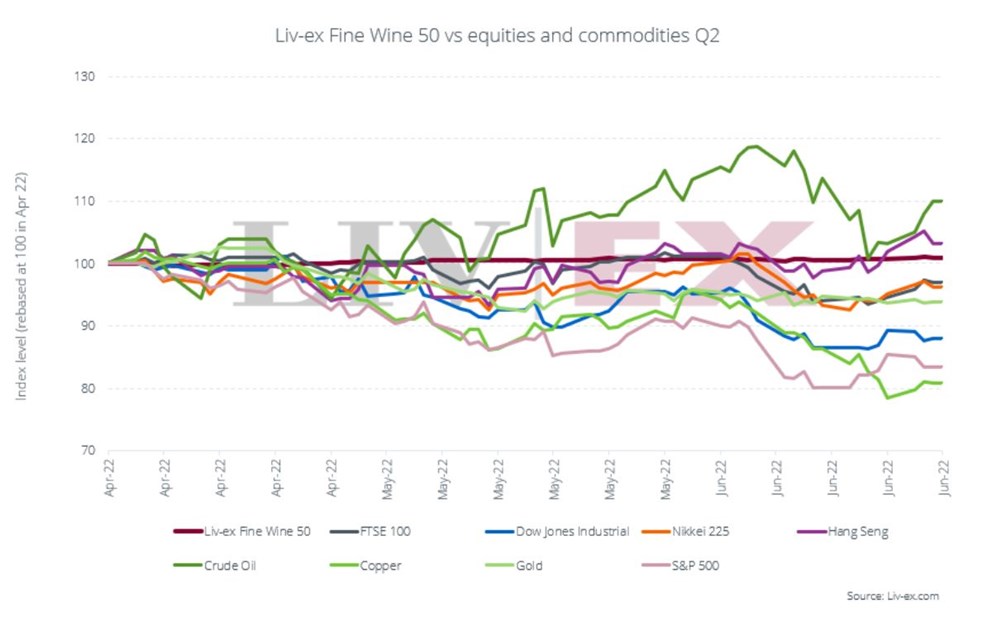

You can read a summary of the latest fine wine market performance here.

E-mail us to discuss or start investing.

*Knight Frank Wealth Report, 2022